Understanding Vietnam’s Production Field Landscape

Vietnam has emerged as a formidable player in the global manufacturing arena, transforming rapidly from an agrarian economy into a dynamic production hub. This section offers an essential overview of Vietnam’s diverse production sectors, highlighting their immense economic significance and their substantial contribution to the national Gross Domestic Product (GDP). Such an understanding is crucial for any comprehensive the trend report of the risk of production field in vietnam, as it sets the vital context for analyzing potential challenges and opportunities within this rapidly evolving industrial environment.

1. Key Industries and Growth Sectors in Vietnam

Vietnam’s industrial landscape is characterized by a robust and diversifying base. The manufacturing sector stands as the undeniable backbone of the nation’s economic growth, attracting significant Foreign Direct Investment (FDI). High-tech manufacturing, particularly in electronics, has seen exponential expansion, with global giants establishing large-scale production facilities for smartphones, computers, and components. This has created a vibrant ecosystem, supporting numerous ancillary industries and driving innovation. Beyond electronics, traditional sectors like textiles, apparel, and footwear continue to be major export earners, employing a substantial portion of the labor market and integrating Vietnam deeply into global supply chains for consumer goods. While industrialization is forging ahead, agriculture and aquaculture remain pivotal, modernizing to focus on higher-value products for export markets. Emerging growth areas include renewable energy, automotive components, and the burgeoning digital economy, reflecting Vietnam’s commitment to industrial upgrade and digital transformation. The government’s proactive policies aim to foster sustainable development across these key sectors, ensuring long-term economic growth.

2. Economic Contribution and Strategic Importance

The production field in Vietnam contributes significantly to the national economy, consistently accounting for a substantial portion of the country’s GDP. This economic significance extends beyond mere numbers, positioning Vietnam as a critical node in global trade and manufacturing networks. Its strategic geographical location, coupled with an extensive network of free trade agreements such as the CPTPP and EVFTA, enhances its appeal as an investment destination and a reliable manufacturing base. These agreements provide preferential access to major markets, bolstering Vietnam’s export-driven economy. The nation’s stability, improving infrastructure, and a young, dynamic labor market further underpin its attractiveness. Furthermore, Vietnam’s role in diversifying global supply chains has gained particular prominence in recent years, making it an indispensable partner for international corporations seeking resilience and efficiency. Understanding the nuanced dynamics of these contributions is fundamental when compiling the World Bank’s insights into Vietnam’s economy, which underscore the nation’s increasing integration and influence on the global stage. This sustained growth and strategic positioning directly impact the trend report of the risk of production field in vietnam, necessitating a thorough analysis of market forces, regulatory environment, and competitive advantages, including consideration of various geopolitical factors affecting international trade.

3. Geographic Distribution of Production Hubs

Vietnam’s production capabilities are distributed across distinct production hubs, each with specialized strengths and robust infrastructure. The northern region, anchored by Hanoi, Bac Ninh, and Hai Phong, is a powerhouse for high-tech manufacturing, particularly electronics and automotive assembly. This area benefits from proximity to China and well-developed logistics networks. The southern economic zone, encompassing Ho Chi Minh City, Binh Duong, and Dong Nai, represents the traditional manufacturing heartland, hosting a diverse range of industries including textiles, footwear, food processing, and advanced logistics centers. This region is characterized by a dense population, skilled workforce, and extensive port facilities crucial for international trade. The central coast, with cities like Da Nang and Quang Nam, is emerging with investment in high-tech parks and tourism-related industries, aiming to leverage its strategic position and developing infrastructure. This decentralized yet interconnected approach to industrial development helps mitigate risks by diversifying production centers and fostering regional development and resilience against potential disruptions. The government’s focus on **sustainable** industrial parks and improving inter-regional connectivity continues to shape the evolving landscape of these hubs, reflecting a conscious effort towards balanced economic growth and resilience against potential disruptions.

In conclusion, Vietnam’s production field landscape is one of remarkable dynamism and strategic importance. Its diverse industrial base, significant economic contributions, and strategically distributed production hubs form a complex yet resilient system. Analyzing these foundational elements is paramount for accurately assessing the trend report of the risk of production field in vietnam, providing a holistic perspective on both the inherent strengths and potential vulnerabilities within this pivotal Southeast Asian economy.

Current Risk Landscape: Key Threats Identified (2023-2024)

Examining the trend report of the risk of production field in Vietnam, this section delves into the immediate and pressing risks currently impacting Vietnam’s manufacturing sector challenges. By categorizing these threats, we aim to provide a clear understanding of the present challenges and their potential repercussions on Vietnam’s production risks and economic stability Vietnam. The period of 2023-2024 has seen a dynamic shift in global and local factors, necessitating a focused analysis of the vulnerabilities facing the nation’s key industries.

1. Geopolitical Tensions and Trade Policy Impacts

The global geopolitical landscape continues to be a significant determinant of Vietnam’s industrial health. Escalating trade wars impact between major global powers, particularly the US and China, creates an unpredictable environment for Vietnamese exporters and domestic manufacturers. While Vietnam has historically benefited from trade diversions, this strategy is not without its own set of export market volatility risks. Sudden shifts in tariffs, trade agreements, and diplomatic relations can severely disrupt established trade routes and market access, affecting revenue streams and long-term investment planning. For instance, increased scrutiny on origin labeling or sustainability practices in key import markets could pose new hurdles.

Furthermore, regional disputes and political instabilities within Southeast Asia, though less direct, contribute to a sense of uncertainty. These tensions can influence foreign direct investment (FDI) decisions, impacting the influx of capital and technology essential for the growth of Vietnam’s production fields. Businesses must navigate complex regulatory compliance frameworks that are constantly evolving in response to these geopolitical currents, demanding agile strategies to mitigate potential losses. Maintaining diversified market access and fostering strong diplomatic ties are crucial for safeguarding the nation’s industrial output against these external pressures, ensuring continued energy security and resource availability amidst global competition.

2. Environmental Vulnerabilities and Climate Change Effects

Vietnam’s extensive coastline and reliance on agriculture make it acutely vulnerable to the intensifying effects of climate change Vietnam. The production sector, especially agriculture-based manufacturing and aquaculture, faces direct threats from extreme weather events such as prolonged droughts, severe floods, and stronger typhoons. These events devastate raw material supplies, disrupt transportation networks, and damage industrial infrastructure, leading to significant production losses and increased operating costs. For example, the Mekong Delta, a critical agricultural and industrial hub, is increasingly threatened by rising sea levels and saltwater intrusion, impacting crucial inputs for various industries.

Beyond immediate disasters, long-term environmental degradation, including air pollution in urban industrial zones and water scarcity, poses sustained challenges. These conditions not only affect the health and productivity of the labor shortage Vietnam workforce but also necessitate higher investments in environmental mitigation and sustainable practices. Businesses are increasingly expected to adhere to stricter environmental standards, often requiring costly upgrades to facilities and processes. The urgent need for infrastructure resilience against environmental shocks is paramount, pushing for investments in green technologies and sustainable supply chain management. The Asian Development Bank’s Vietnam Economic Outlook frequently highlights the economic implications of these environmental shifts, underscoring the critical need for proactive adaptation strategies across all Vietnam production risks.

3. Supply Chain Disruptions and Operational Risks

The fragility of global global supply chain resilience has been starkly exposed in recent years, presenting ongoing challenges for Vietnam’s production fields. Reliance on specific countries for critical raw materials, intermediate goods, or advanced machinery leaves Vietnamese manufacturers susceptible to external shocks, from pandemics and geopolitical restrictions to natural disasters in supplier regions. This has led to volatile raw material costs and extended lead times, squeezing profit margins and delaying production schedules across various sectors. The automotive, electronics, and textile industries, heavily integrated into global networks, are particularly vulnerable to these cascade effects.

Operational risks within Vietnam also contribute significantly to these disruptions. Inadequate logistics infrastructure, although improving, can still hamper the efficient movement of goods. Furthermore, the rapid pace of technological advancement, while offering opportunities, also introduces new vulnerabilities. Industries embarking on digital transformation risks face challenges related to cybersecurity threats, data breaches, and the complex integration of new systems. Ensuring robust cybersecurity threats protocols and investing in workforce training are critical to safeguarding production continuity. Furthermore, rising inflation pressures contribute to increased operational expenditures, impacting the overall cost of production and competitiveness. A comprehensive trend report of the risk of production field in Vietnam reveals that diversification of suppliers, investment in localized production capacities, and enhancement of technological safeguards are essential strategies for building greater resilience against these multi-faceted supply chain and operational risks, ensuring the long-term viability of manufacturing sector challenges in Vietnam.

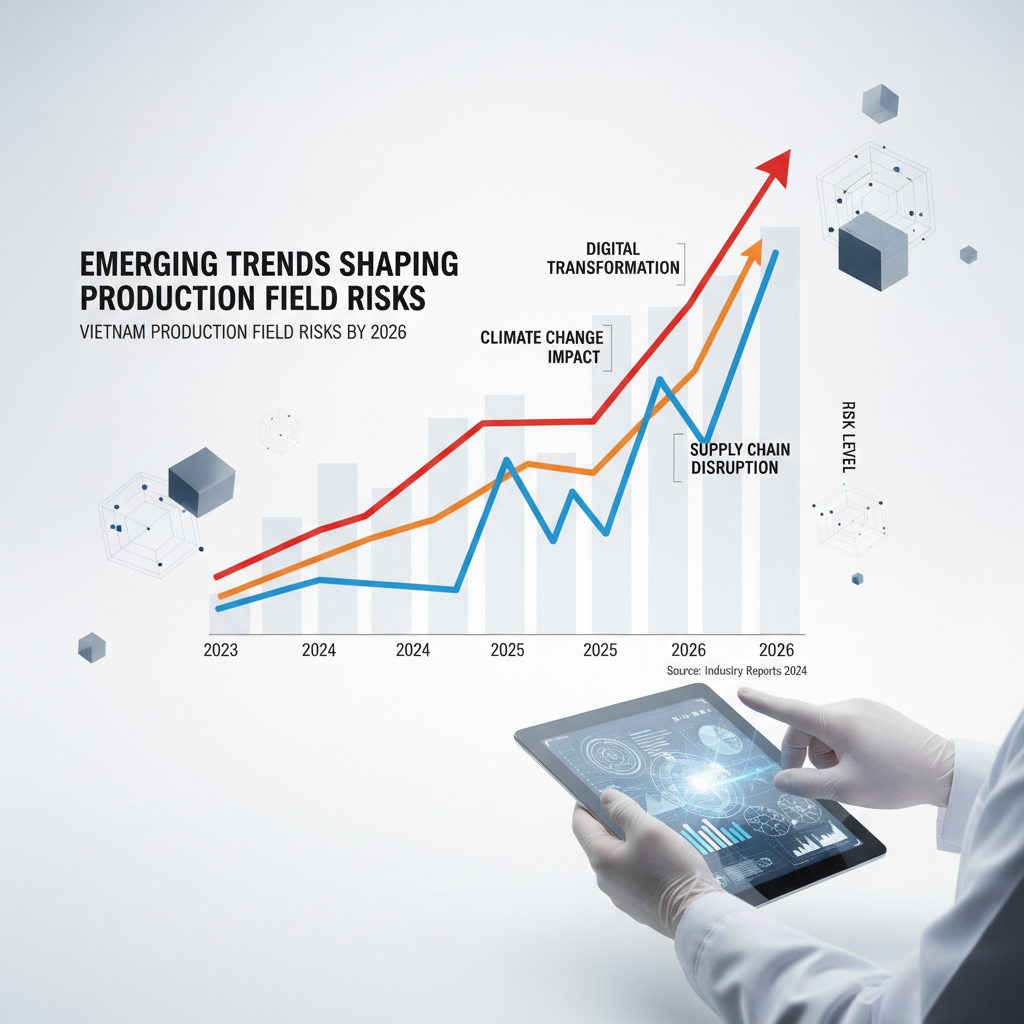

Emerging Trends Shaping Production Field Risks

Vietnam’s production fields are navigating a landscape of rapid economic development and global transformations, leading to an increasingly dynamic and evolving risk profile. Understanding these significant trends, both domestic and global, is crucial for effective risk management strategies and ensuring operational continuity. This section provides critical insight into key challenges reshaping the risk profile for production fields across Vietnam, highlighting areas where proactive measures are vital.

1. Digital Transformation and Automation Adoption Rates

The accelerating pace of digital transformation and automation is fundamentally reshaping production field operations, presenting both immense opportunities and complex risks. Vietnam’s push towards Industry 4.0 technologies—including the Internet of Things (IoT), AI, and advanced robotics—promises enhanced operational efficiency, improved predictive maintenance, and remote control capabilities. Smart sensors monitor equipment health, reducing downtime and improving safety by minimizing human exposure to hazardous environments. Data analytics further refine decision-making, optimizing resource allocation and production outputs.

However, this technological leap introduces a new spectrum of cybersecurity threats. Interconnected production fields are potential targets for cyber-attacks that could disrupt operations or steal sensitive data. The complexity of integrating diverse digital systems and constant reliance on updates create new vulnerabilities. Furthermore, initial investment costs and the need for specialized technical expertise pose significant hurdles. Managing these digital assets effectively, ensuring robust network security, and developing comprehensive incident response plans are paramount for mitigating these evolving risks in Vietnam’s production sector.

2. Shifting Labor Market Dynamics and Skill Gaps

Vietnam’s production fields are increasingly impacted by evolving labor market dynamics, which present significant challenges related to workforce development and sustainability. A noticeable trend is the emergence of significant skill gaps. As automation and digital technologies become more prevalent, the demand for traditional manual labor skills decreases, while the need for employees proficient in data analytics, AI operation, robotics maintenance, and advanced IT infrastructure management grows rapidly. Many existing workforces, particularly in established production fields, may lack these specialized competencies, creating a disparity between available skills and industry requirements.

Concurrently, demographic shifts and changing career aspirations among younger generations contribute to talent retention issues. Growing competition for skilled talent means production fields must adapt to attract and retain a competent workforce capable of navigating modern operations. Inadequate training, an aging workforce, and the struggle to attract new talent can lead to operational inefficiencies, safety concerns, and increased production risks. Addressing these skill gaps through targeted training programs, fostering continuous learning, and strategic recruitment are essential to build a resilient and capable workforce for the future.

3. Regulatory Changes and Compliance Burdens

The regulatory landscape governing production fields in Vietnam is in constant flux, driven by both domestic policy priorities and international commitments, thereby significantly increasing compliance burdens and introducing new categories of risk. A primary driver is the heightened global focus on sustainability and environmental compliance. Vietnam is intensifying efforts to combat climate change, reduce carbon emissions, and promote responsible resource management. This translates into stricter environmental impact assessments, more stringent discharge limits, and increased requirements for waste management and pollution control technologies.

Furthermore, evolving international trade agreements and regional geopolitical risks can introduce new tariffs, sanctions, or logistical challenges that directly impact supply chain resilience and market access. Production fields must also navigate updated safety standards and labor laws designed to enhance worker protection and operational integrity. Non-compliance with these evolving regulations can result in substantial fines, reputational damage, operational shutdowns, and even the revocation of operating licenses. Proactive monitoring of regulatory developments, robust internal compliance frameworks, and strong stakeholder engagement are critical for mitigating these regulatory risks and ensuring the long-term viability and investment security of production operations in Vietnam. This includes adapting to shifts in energy transition policies, which might impact existing infrastructure vulnerability.

The analysis presented in this trend report of the risk of production field in vietnam underscores the multifaceted nature of modern operational challenges. From leveraging technological advancements to addressing human capital and navigating complex regulatory environments, a holistic approach to risk assessment and mitigation is indispensable for securing the future of Vietnam’s vital production sector.

Forecasting Future Risks and Opportunities (2025-2026)

As Vietnam strengthens its position as a global manufacturing hub, understanding the future landscape of its production fields is crucial. The period spanning 2025-2026 is anticipated to be a dynamic phase, presenting both evolving challenges and unprecedented opportunities. This forward-looking analysis offers a comprehensive trend report of the risk of production field in Vietnam, examining critical factors from environmental pressures to geopolitical shifts and technological advancements that will shape the nation’s industrial trajectory.

1. Long-Term Climate Scenarios and Adaptation Needs

Vietnam’s inherent geographic vulnerability places it at the forefront of climate change impacts, posing significant risks to its production fields. The Mekong Delta, a vital agricultural and aquaculture powerhouse, faces escalating threats from rising sea levels, saltwater intrusion, and more frequent extreme weather events. These phenomena directly impact agricultural output, disrupt supply chains, and threaten critical infrastructure, potentially leading to production downtime and increased operational costs. Manufacturing sectors reliant on consistent water supply or coastal logistics, such as textiles and food processing, will also face mounting pressures. For example, during droughts, hydroelectric power generation can be compromised, affecting industrial energy supply.

The imperative for adaptation is clear. Future strategies must focus on investing in resilient infrastructure, like improved dykes and irrigation systems, and promoting sustainable, circular economy practices within manufacturing, including water recycling and energy efficiency. Adopting climate-smart agriculture and developing resilient crops can mitigate food security risks. This scenario also presents opportunities for growth in green technologies, renewable energy solutions, and eco-friendly production methods, attracting green foreign direct investment (FDI). Proactive planning and substantial investment in these adaptation measures are crucial to safeguard Vietnam’s long-term productive capacity. According to the World Bank, Vietnam is one of the countries most affected by climate change, underscoring the urgency of these adaptation efforts.

2. Evolving Geopolitical Alliances and Regional Stability

The geopolitical landscape of Southeast Asia and the broader global arena will continue to significantly influence Vietnam’s production fields. Shifting alliances, trade disputes between major powers (e.g., US-China), and regional stability directly impact supply chain resilience, market access, and investment flows. Vietnam has notably benefited from global supply chain diversification strategies, attracting significant FDI as companies seek to de-risk their operations from over-reliance on single manufacturing hubs. This trend is expected to continue, positioning Vietnam as an even more attractive alternative for high-tech manufacturing, electronics, and textiles.

However, risks persist. Increased protectionism globally or regional trade tensions could disrupt Vietnam’s export-oriented economy, particularly if key export markets impose new tariffs or non-tariff barriers. Maintaining stable relations with major trading partners and actively participating in regional trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) will be critical. These agreements offer preferential market access and foster a stable trade environment, reducing uncertainty for manufacturers. The government’s strategic navigation of these complex geopolitical currents, balancing economic openness with national interests, will largely determine the resilience and growth trajectory of its production sector.

3. Impact of Innovation and R&D Investments

The relentless march of technological innovation, particularly Industry 4.0 principles like automation, AI, and IoT, will fundamentally transform Vietnam’s production fields by 2026. Significant investments in research and development (R&D) are essential for Vietnam to move beyond low-cost manufacturing and ascend the global value chain. Automation and robotics can address labor shortages and increase efficiency, especially in labor-intensive sectors. AI and big data analytics offer unprecedented capabilities for predictive maintenance, quality control, and optimizing supply chain logistics, leading to reduced waste and improved productivity.

However, this transition also presents risks, primarily the potential for job displacement in traditional manufacturing roles and the demand for a highly skilled workforce. Bridging this skill gap through vocational training, upskilling programs, and collaboration between industry and academia will be crucial. Cybersecurity threats to interconnected smart factories will also demand robust protective measures. On the opportunity side, embracing these innovations can significantly enhance Vietnam’s competitiveness, foster the development of high-value-added products, and attract advanced manufacturing FDI. It opens avenues for new industries, such as smart agriculture technology and advanced materials. Strategic investments in digital infrastructure, intellectual property protection, and fostering an innovation ecosystem are vital for Vietnam to fully capitalize on these technological advancements and secure its future as a sophisticated and competitive manufacturing powerhouse.

Mitigating Production Field Risks: Strategic Recommendations

Vietnam’s production sector, a cornerstone of its economic success, faces a dynamic array of challenges, from supply chain disruptions to climate change impacts and evolving cyber threats. As highlighted in the trend report of the risk of production field in Vietnam, proactively addressing these vulnerabilities is paramount for sustained growth and competitiveness. This section provides actionable strategies and recommendations for businesses and policymakers to effectively manage, reduce, and build resilience against identified risks, ensuring a robust and future-proof manufacturing landscape. By adopting a forward-thinking approach, stakeholders can transform potential threats into opportunities for innovation and sustainable development.

1. Enhancing Supply Chain Resilience and Diversification

The COVID-19 pandemic starkly exposed the fragility of global supply chains, underscoring the critical need for resilience and diversification within Vietnam’s production sector. To mitigate future shocks, businesses must move beyond single-source dependencies and adopt multi-faceted strategies. This includes diversifying supplier bases across different geographies, exploring regionalization of manufacturing processes to reduce transit times and reliance on distant markets, and investing in robust inventory management systems. Implementing advanced data analytics and AI-driven predictive tools can help identify potential bottlenecks and disruptions before they escalate, allowing for proactive adjustments. Furthermore, fostering stronger, more transparent relationships with suppliers and logistics partners through collaborative platforms can enhance visibility and coordinated response during crises. Policymakers can support these efforts by promoting free trade agreements, developing critical infrastructure, and offering incentives for companies that invest in secure, diversified supply networks. Strengthening logistics infrastructure, including port capacity and inland transportation networks, is also crucial for improving the flow of goods and raw materials, bolstering the overall  resilience of production operations in Vietnam.

resilience of production operations in Vietnam.

2. Investing in Sustainable Practices and Green Technologies

Addressing environmental risks and transitioning towards a green economy are no longer optional but essential for the long-term viability of Vietnam’s production field. Investing in sustainable practices and green technologies offers a dual benefit: mitigating climate-related risks and enhancing market competitiveness. This involves adopting renewable energy sources, optimizing energy efficiency in manufacturing processes, and implementing circular economy principles to reduce waste and maximize resource utilization. Businesses should explore eco-friendly materials, embrace advanced wastewater treatment technologies, and reduce their carbon footprint through responsible waste management. Policymakers play a vital role in accelerating this transition by offering tax incentives, subsidies for green technology adoption, and developing clear regulatory frameworks for environmental compliance. Promoting research and development in sustainable industrial solutions, alongside capacity building programs for workers, will further drive the adoption of cleaner production methods. Embracing these initiatives aligns Vietnam’s production sector with global sustainability goals, enhances its reputation, and unlocks new market opportunities driven by environmentally conscious consumers and investors, contributing significantly to Vietnam’s sustainable industrial development initiatives. This strategic shift not only builds resilience against climate change impacts but also future-proofs businesses against evolving environmental regulations and consumer demands.

3. Strengthening Cybersecurity Frameworks and Data Protection

As Vietnam’s production sector increasingly embraces digitalization and automation, the threat of cyberattacks becomes more pronounced. Protecting critical infrastructure, intellectual property, and sensitive customer data is paramount. Businesses must establish robust cybersecurity frameworks that include multi-layered defense strategies, regular vulnerability assessments, and penetration testing. Implementing strong data encryption, access controls, and secure network architectures are fundamental. Continuous employee training on cybersecurity best practices and phishing awareness is crucial, as human error often remains a significant vulnerability. Developing comprehensive incident response plans to swiftly detect, contain, and recover from cyber breaches is also essential. From a policy perspective, the government should continuously update national cybersecurity laws and regulations, harmonize them with international standards, and foster public-private partnerships to share threat intelligence and expertise. Establishing a national cybersecurity agency dedicated to industrial control systems and manufacturing could provide specialized support and guidance. By proactively strengthening cybersecurity, Vietnam can safeguard its production capabilities, maintain investor confidence, and ensure the integrity of its digital transformation journey, reinforcing its position as a secure and reliable manufacturing hub.

Partner with Shelby Global

You are looking for reliable HR Sevice Suppliers? Contact Shelby Global Now! To connect with verified talents and upgrade your orginization.

—————————————

References

– World Bank Vietnam Overview: https://www.worldbank.org/en/country/vietnam/overview

– :

– How digitalisation is transforming energy systems: https://www.iea.org/commentaries/how-digitalisation-is-transforming-energy-systems

– World Bank – Vietnam Overview: https://www.worldbank.org/en/country/vietnam/overview#1

– World Bank in Vietnam: Overview: https://www.worldbank.org/en/country/vietnam/overview#2